Frozen Pipes & Winter Claims: What Kansas City Homeowners Need to Know

Winter in Kansas City is famously unpredictable—one week you’re back-yard grilling, the next you’re waking up to frozen pipes. When the cold hits, frozen (and sometimes burst) pipes are one of the most common and expensive headaches for homeowners and business owners locally. Below is a plain-spoken guide to help you avoid a claim—and, if the worst happens, make the claim process smoother.

Why pipes freeze (and why KC is at risk)

Pipes freeze when the water inside drops to 32°F and expands. The spots that tend to give you trouble in KC are:

Pipes in exterior walls, attics, garages, and crawlspaces

Outdoor hose bibs and irrigation lines

Pipes near windows, doors, or unsealed openings where cold air sneaks in

KC’s mix of older homes, seasonal construction differences, and occasional sharp deep freezes means we often see local spikes in frozen-pipe claims after a multi-day cold snap.

Be preventative—do these things now:

Insulate exposed pipes with foam sleeves or batt insulation.

Seal air leaks around where pipes enter the building, and around windows/doors.

Keep the heat on when you’re away—many insurers recommend no lower than ~55°F for vacant properties (verify your policy).

Open cabinet doors under sinks during extreme cold so warm air reaches pipes.

Let faucets drip during hard freezes to reduce pressure and help prevent freezing.

Disconnect and drain outdoor hoses and winterize irrigation systems.

Consider heat tape or thermostatically controlled cable for especially vulnerable pipes.

If a home/business will be vacant, follow your insurer’s winterization requirements—failure to do so is a common reason for denials.

How insurance typically treats frozen-pipe claims

Usually covered: sudden and accidental damage from a burst pipe (repairs to pipe, property damage, and lost contents up to policy limits).

Often not covered: long-term leaks caused by neglect, or damage to a property that was vacant without required winterization. (Some carriers offer limited hidden water damage coverage)

Separate issues: flood from rivers/overland water is not covered by standard homeowner/commercial policies—that requires a flood policy. Sewer backups are usually excluded unless endorsed on the policy. We always recommend water backup coverage at a minimum of $200 per finished square foot in the basement. (Fore example: 1000 sqft basement = $20,000+ in coverage)

Emergency measures: reasonable costs to stop further damage (plumber call-outs, temporary repairs) are typically reimbursed—keep every receipt.

If a pipe bursts—what to do first (the actions that save claims)

Shut off the water at the main valve or at the nearest shutoff.

Call an emergency plumber and keep the invoice.

Mitigate damage—get standing water out, move wet contents to dry areas, and begin drying safely.

Document everything: timestamped photos and video of damage and the broken pipe(s).

Call your agent or the carrier’s claims line—they’ll guide you on mitigation and claims paperwork.

Avoid permanent repairs until the adjuster signs off, but don’t delay reasonable emergency repairs to stop further damage.

Stats & local context

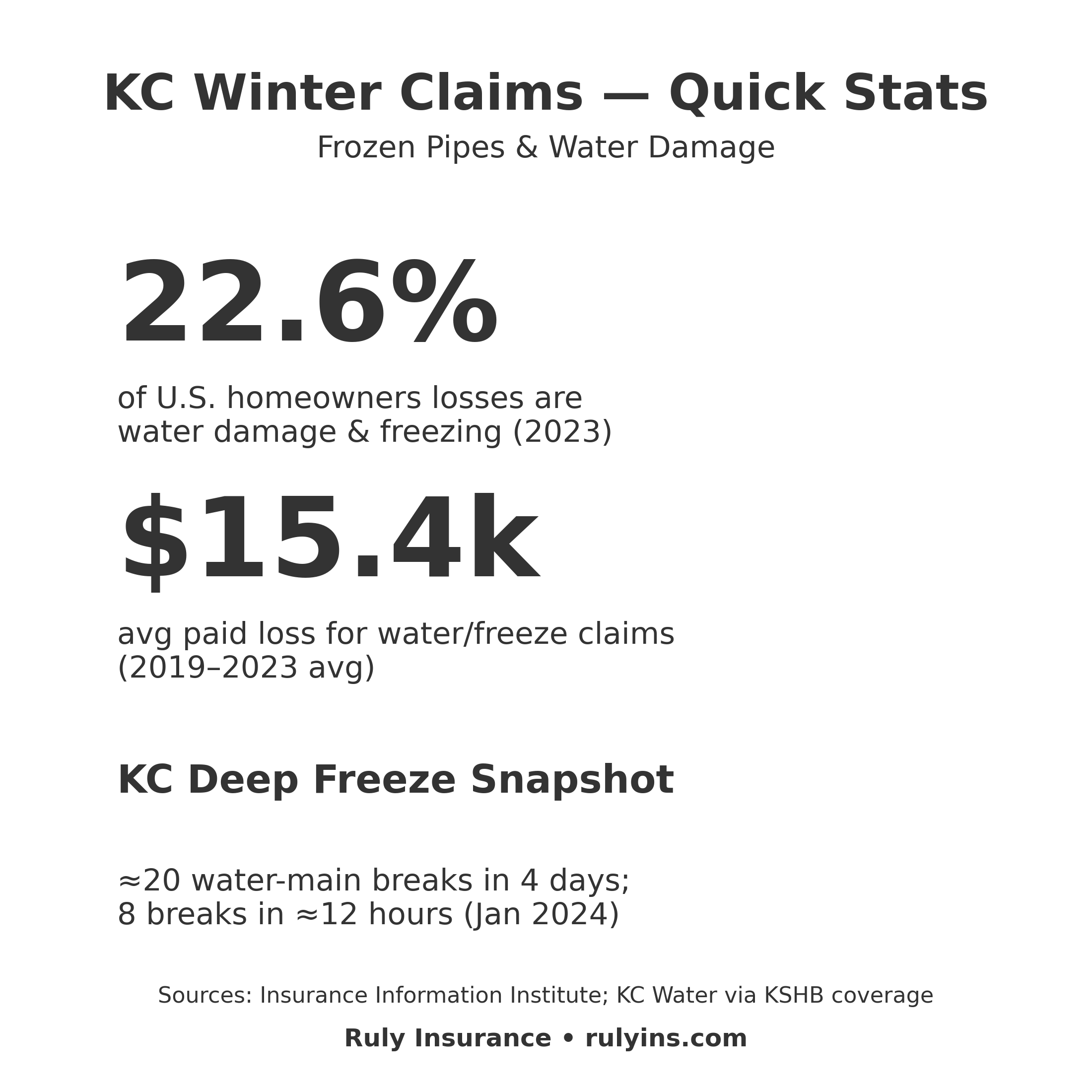

Kansas City Winter Claim Data

Kansas City snapshots

During the January 12–15, 2024 cold snap, KC Water reported ~20 water-main breaks in four days, with 8 breaks in about 12 hours at the peak. That matches what we see: hard freezes → clusters of bursts.

KC maintains ~2,800 miles of water lines; the city has averaged ~792 water-main breaks/year since 2016 (down from 1,844 in 2012 thanks to replacements)—a good proxy for how cold snaps stress local systems.

Missouri context

The Missouri DCI tracks insurance losses and market stats and confirms severe weather is a primary driver of property claims and premium pressure statewide. In 2025 YTD (as of Jul 16), insurers reported 173,000+ catastrophe claims and $1.6B paid, $1.3B of it on residential property. (Not just frozen pipes—but it shows how weather drives losses here.)

Supporting National data

Share of losses: “Water damage & freezing” accounted for ~22.6% of U.S. homeowners losses in 2023, second only to wind/hail. (Five-year span 2019–2023 shows water/freeze consistently among top causes.)

Average paid loss (severity): For 2019–2023, average paid homeowners loss for water damage & freezing was ~$15,400 per claim. (Overall homeowners severity across all causes averaged $17,059.)

How often it happens: Roughly 1 in 67 insured homes has a water-damage or freezing claim in a typical year.

Important takeaways

Frozen pipes commonly cause sudden, widespread water damage after a hard freeze.

Prevention (insulation, heat, winterizing outdoor lines) is far cheaper than cleanup.

Insurers usually cover sudden burst-pipe damage — but not damage from long-term neglect or from a property left vacant without required winterization. (Usually it’s 60+ days when the exclusions kick in)

Document everything—photos, receipts, plumber invoices—and call your agent ASAP.

Want to learn more?

Ruly Insurance is happy to do a quick winter-risk review for Kansas City homeowners and small businesses—we’ll point out vulnerable pipes,

advise on winterization, and review vacancy/winterization policy language. Call (913) 229-6222 or email service@rulyins.com.

Ready for a quote? We can do that too.

Sources

Insurance Information Institute (ISO/Verisk data): Homeowners loss frequency/severity and “water damage & freezing” share & severity (2019–2023). III+1

KSHB 41 (Kansas City): Jan 2024 deep-freeze coverage; KC Water spokesperson on ~20 breaks/4 days and 8 in ~12 hours. KSHB 41 Kansas City News+2KSHB 41 Kansas City News+2

KC Water (city PDF): “What’s on Tap” (Winter 2022): 2,800 miles of lines; ~792 breaks/year since 2016; historical context. Kansas City Water

Missouri Department of Commerce & Insurance: 2025 YTD catastrophe claims & payouts; statewide severe-weather impact. Missouri Commerce & Insurance